Introduction

As part of my series on travel hacking with ITA Matrix, I’d like to talk about another use for my favorite tool for airfare searches and related travel hacking: Forced routings. As a reminder, ITA Matrix great for hidden city ticketing, fuel dumps, free one-ways, forced fare buckets, aircraft selection, multi-class cabin bookings, and avoiding married segments — though I use it for more than that too.

For this one, let’s tackle forced routings.

Why Forced Routings?

A forced routing is one of the simplest travel hacking concepts out there. All it means is that you want to buy an airline ticket, but you only want to pass through certain hubs or use certain carriers to do it.

I use forced routings to the following airports at times:

- ORD in the spring (Tortas Frontera, AA and UA hubs and a DL focus city)

- DFW year round (Centurion Lounge)

- LAX for long layovers (Take a bus to Santa Monica or go plane spotting at In-n-Out on Sepulvida)

- DEN for it’s easy connections with lots of backup options

- SLC for its unparalleled ability to deal with winter storms

- My destination airport for hidden city ticketing, which we’ll address another day

I use forced routings to avoid:

- ORD in the late summer and early fall (delays run rampant)

- SFO most of the year (delays run rampant when the fog sets in or a runway is under construction, which is approximately always)

- PHX in the summer (aircraft are often weight restricted and have to kick people off to meet reduced takeoff weights)

- ATL in the late fall and in January (delays run rampant)

- ATL the rest of the year (I really dislike the airport)

- MIA/PHL/CLT when traveling to Europe (I want my time in the wide-body plane to be long enough to sleep, not just a short hop so I’d rather connect further west)

- United when I know they’re flying a regional jet on a particular route

Forcing Routings in ITA Matrix

How do we use forced routings in ITA Matrix? It’s actually really simple.

- Turn on “Advanced controls” if they’re not already enabled

- Enter the airport abbreviation in “Outbound routing codes” as appropriate:

- Enter “ATL” to force routing through ATL

- Enter “~ATL” avoid routing through ATL (the tilde means “avoid”)

- Enter “DEN,ORD” to route through one of DEN or ORD, either way is fine

- Enter “~DEN,ORD” to avoid routing through either DEN or ORD

- Enter “DEN ORD” to route through two hubs, DEN and ORD in that order

- Enter the rest of the data as needed for the trip

- Click “Search”

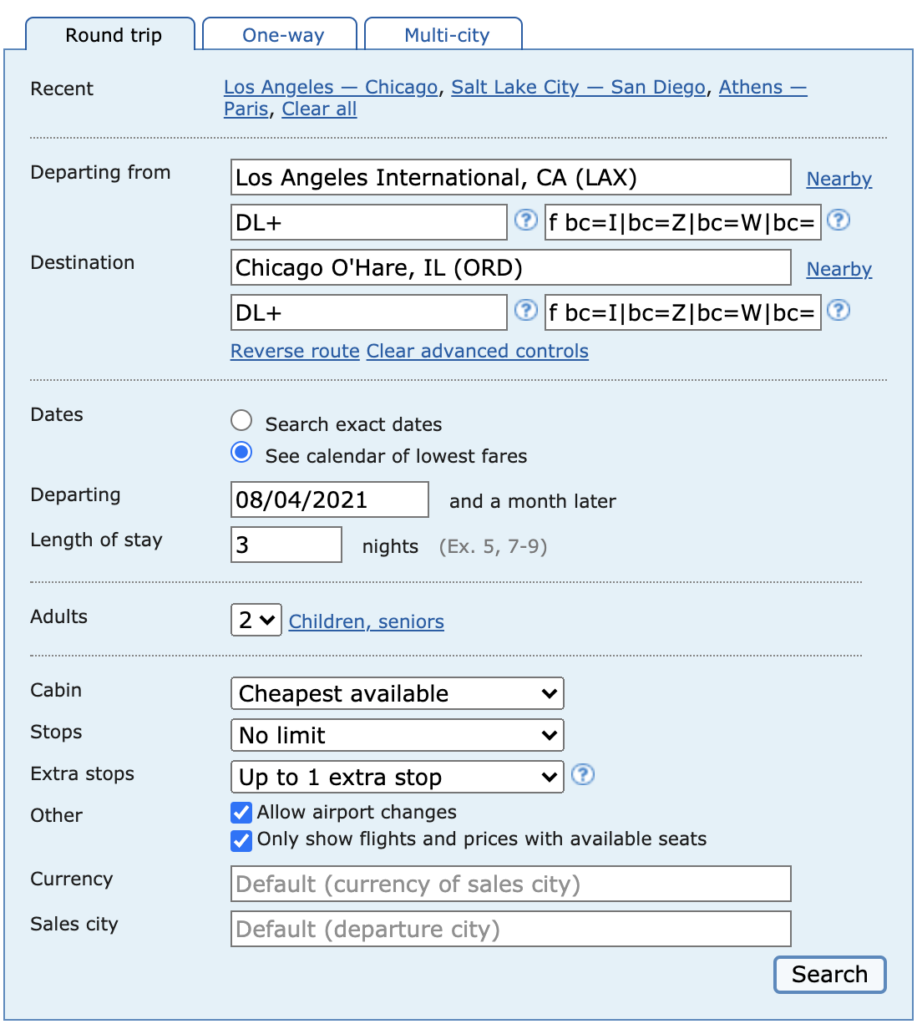

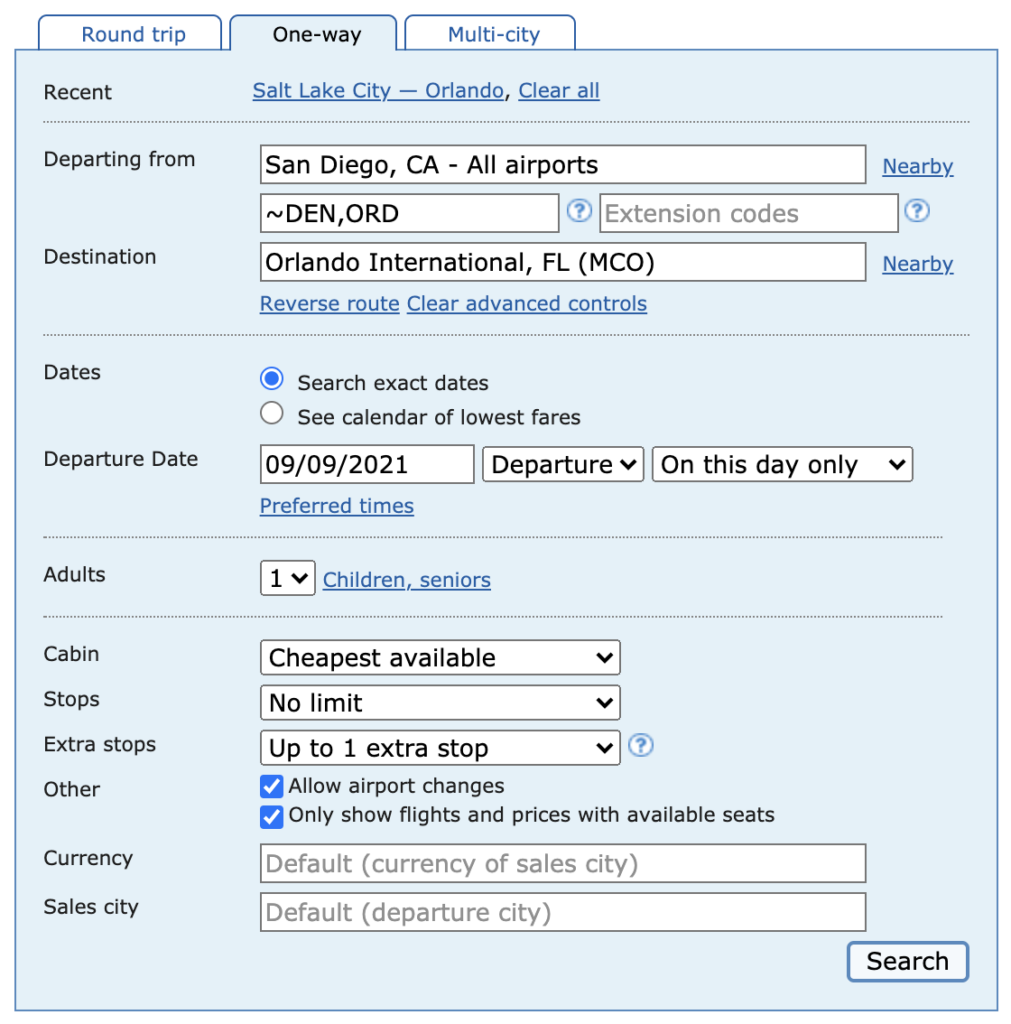

Here’s a screenshot showing a trip that avoids passing through DEN or ORD (scenario 4):

Forced Routings and Carriers in ITA Matrix

Not bad, eh? Let’s get a little more complex though. With a little elbow grease you can force yourself to be on specific carriers and route through particular hubs. Let’s say I want to fly Delta to ORD and United to ATL on the same ticket. No problem, carriers just go before and after the hub as carrier codes.

Let’s look at this example:

- Turn on “Advanced controls” if they’re not already enabled

- Enter carriers and hubs in “Outbound routing codes” as appropriate:

- Enter “DL ORD UA” for a direct flight on Delta to ORD, then a direct flight on United to the destination

- Enter “DL+ ORD UA” for a direct or connecting flight on Delta to ORD, then a direct flight on United to the destination

- Enter “~F9 ORD UA+” to fly a direct flight on any airline but Frontier to ORD, then a direct or connecting flight on United to the destination

- Enter the rest of the data as needed for the trip

- Click “Search”

The carrier codes for the major US airlines are: Delta: DL, United: UA, American: AA, Frontier: F9, Southwest: WN (though Southwest is different and doesn’t show fares through ITA Matrix, so that one is just trivia for now). Also, in case you didn’t glean it above, the “+” means “one or more legs”.

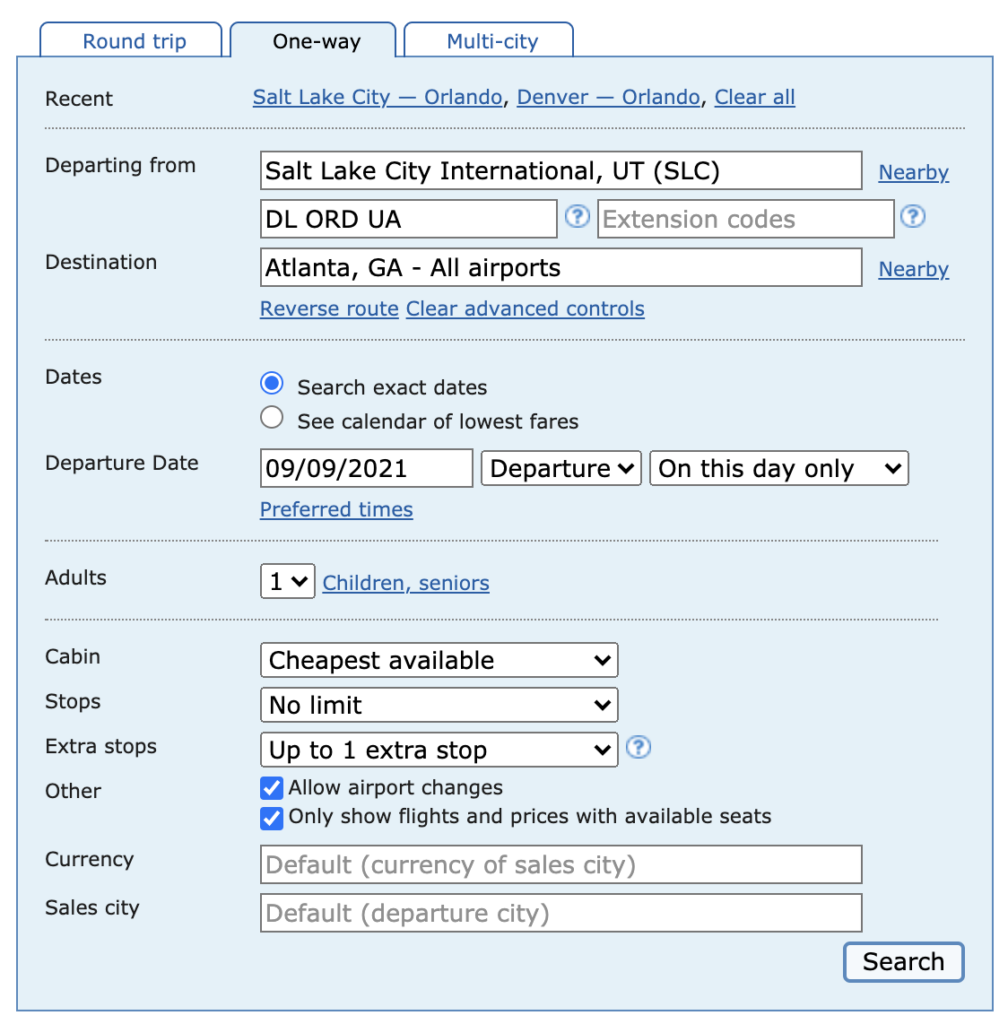

My example (Delta to ORD then United to ATL) will look like this:

Booking the Results

Ok, so you’ve now got your convoluted, forced routing itinerary priced out. How do you book it? Simple, copy the results page and paste it into bookwithmatrix.com, which will then let you forward the itinerary to several booking agencies (in this case my options were Delta or Priceline, but that varies based on the itinerary).

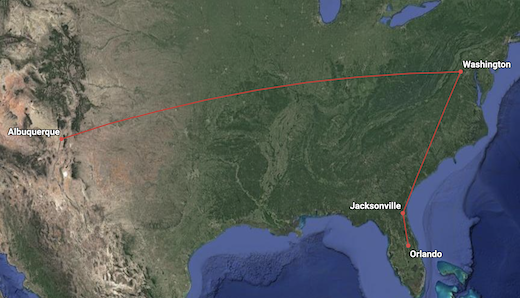

Fun fact: Once I really did connect in JAX between IAD and MCO on purpose. The ground crew was incredulous that anyone would connect in JAX.