- Meijer has $10 off of $150 or more in Mastercard gift cards through Saturday. You have to clip a digital coupon, and you may need multiple MPerks accounts to scale. If you’re even remotely near a Meijer it’s probably worth your time to work this one into your rotation.

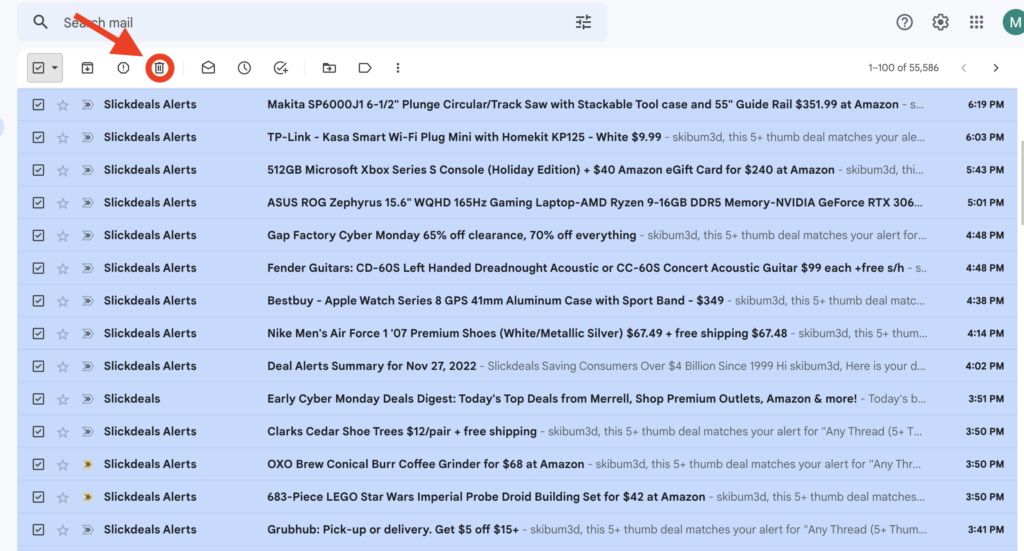

- Black Friday and Cyber Monday are their own kind of special for a manufactured spender. There’s a lot going on but it’s hard to find anything useful in the normal channels because deals are lost in the noise of vacuum cleaner sales, PS5 snipe hunting, letters from your local shop letting you know that they’ve slashed prices by upwards of 3%, and by the extreme desire to search your inbox for “is:unread” followed by a mass delete. For today only, slickdeals is probably the best place to keep a focused eye (normally they’re too slow to pay much attention to for our kind of deals), specifically with one of the following links:

– General Cyber Monday deals

– Visa gift cards

– Mastercard gift cards

– Airline sales

– Stephen’s Black Friday Gift Card deals (Ok, so this isn’t slickdeals but it is just as good)One thing to watch out for is that slickdeals runs its own shopping portal and the rates typically aren’t as good as you can find elsewhere, always check cashbackmonitor.com.

- Giftcards.com has multiple new codes for 5% off of Virtual Visas through Thursday: BFVIP, BFVISA5, CMVISA5, and BFVISA. You can get $2,000 in virtual cards every 48 hours per Giftcards.com account, and remember to go through a portal too. In case you’re on the fence. The break-even point not including portal bonuses and credit card rewards is 2.74%, so it’s easy to make this work in your favor.

- The American Express Business Platinum card’s public offer is now occasionally 170,000 Membership Rewards with $15,000 in spend. As usual with the AmEx random number generator, if you don’t see the offer then try:

– Incognito

– Mobile versus desktop

– A different browser

– Search for “American Express Business Platinum” with several search engines and click the first non-sponsored link

– A VPN to another part of the USThis offer does have lifetime language, but we all know the popup is more important than the language, right? (Thanks to DoC)

- Check the following airline promo pages for Cyber Monday sales and rebook existing travel when it makes sense:

– United Airlines flight promos

– Delta Air Lines flight promos

– Southwest Airlines cyber monday promos

– Alaska Airlines cyber monday sale

– American Airlines travel dealsI’ll update the above links as it makes sense throughout the day.

- Check the Fluz mobile app for upcoming parties and RVSP or join any interesting ones. For our purposes, the most interesting is probably 30% off today for Uber Eats gift cards, which of course work for Uber rides.

MEAB’s coping mechanism between Black Friday and Cyber Monday.