Today, let’s start with a bit of followup and then jump into a few points to keep your eyes on.

On Monday we talked about how Chase might be blocking PayPal Key+Freedom transactions for certain MS channels. Plenty of data points have come in since then, and there’s also been a material change in a particular MS channel too. As of now, it seems that PayPal is actually the culprit for blocking transactions and it’s very targeted and specific. Louses!

Onto the normal post:

1. Login to American Express, then check this link for an authorized user offer for American Express Business Platinum cards. This offer is for 20,000 points when adding an employee card and spending $4,000, up to five times. This is different than the 1.9 Million point offer for 99 users that you can get from calling in; and because it’s a different offer you can be taking advantage of both (though remember you’re limited to 99 employee cards total).

Remember, employee cards don’t need a date of birth or SSN when creating them, they come already activated, and they stay that way for 60 days without providing additional information. (Thanks to Parts_Unknown for the link)

2. Simon Volume has a gift card promotion code GO50SEP21 for half of of fees through October 8. These are great for boosting balances on your Citi cards, especially the Double Cash.

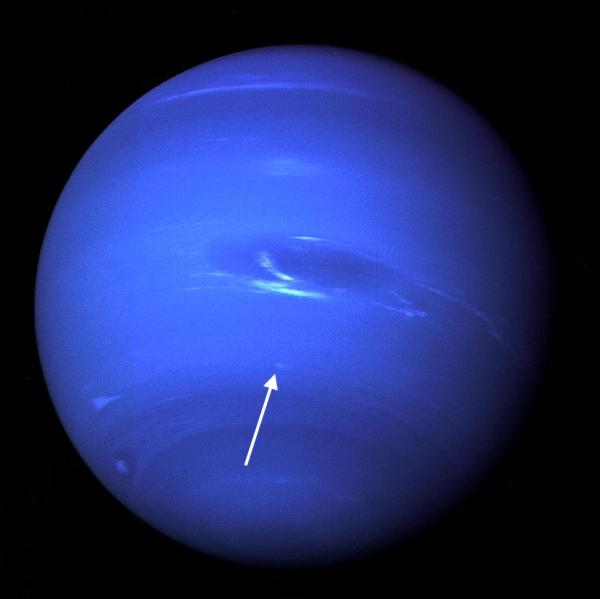

3. If you hold any variety of the American Express Bonvoy card, register this link for a targeted 10x spend on PayPal purchases up to 50,000 points for $5,000 in spend. I was targeted, and believe it or not I will be taking advantage of this because 50,000 points is good for a night or two at an airport hotel when I need a place to stay while transiting.

I hear your head snapping: “Wait, MEAB? You have a Marriott Bonvoy Amex?”

Yes, I famously hate Marriott and yes, I do have the card. It’s the weird $95 annual fee personal card that was converted from the Starwood SPG card when Marriott bought Starwood, and is currently only available by converting another higher annual-fee Marriott. I’ve kept this card despite my hatred of Marriott because:

- I’ve gotten a 60,000 Bonvoy points retention offer on the card each year that I’ve had it

- It’s currently giving me $10 in dining credits every month, easily cashed out at Amazon Meals on Fluz

- It gives me a 35,000 point annual free night certificate every year

If they would stop giving me retention offers on the card I’d get rid of it — but, here we are. AmEx is feeding me exactly what I hate and I apparently keep asking for more.