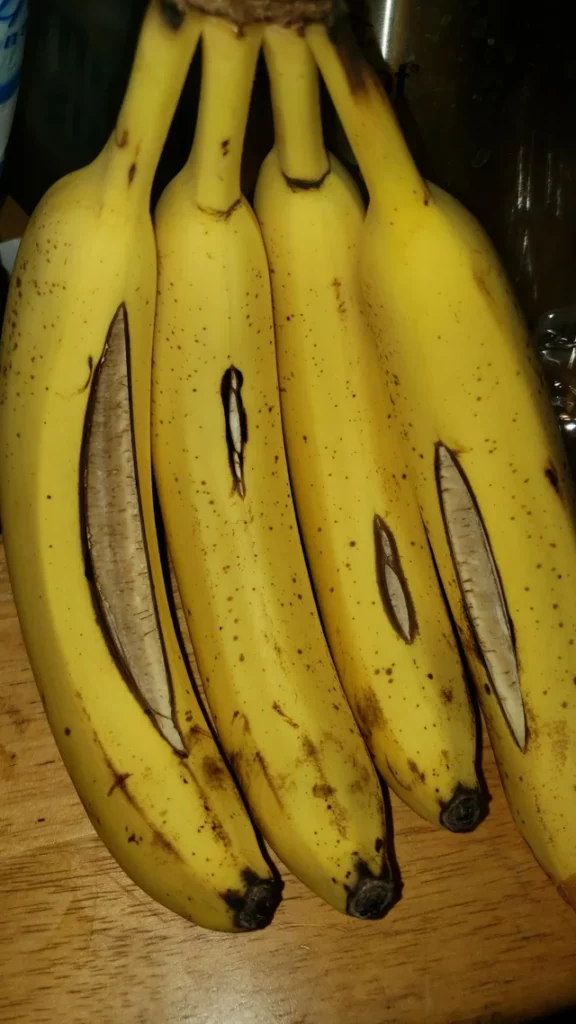

Before we jump in today: If you’re traveling through Amsterdam or London in the next three weeks or so, I’d suggest you call your airline and get rebooked on another route. With that out of the way, there are a few things to keep on your radar for the weekend:

- If you want to play with fire, Chase is offering a $600 sign-up bonus for opening a checking and savings account, depositing $15,000 for 90 days, and setting up direct deposit that’s bigger than an unspecified “micro-deposit” size (I’d set up at least $500 per month to be safe). The offer runs through October 19.

To qualify, you can’t have had an existing checking and savings account for the last 90 days. I wouldn’t do this with P1, but maybe for P3, or for P2 if you keep their manufactured spend profile low.

- Southwest opened its schedule through March 8, 2023 yesterday, and currently we haven’t seen any schedule change sweeps past October 20 so you can still game the holiday season and potentially early spring break travel. (Thanks to Brian M via MEAB slack)

- Do this now: Register for double Hyatt points at MGM properties through October 15. (Thanks to FM)

- The Paceline credit card seems to be good for up to around $10,000 in cash back before a shutdown. I guessed initially that I’d be shutdown almost instantly if I got the card, but I think I was wrong and I’ll be grabbing it soon.

- Giant Eagle stores have 3x or 5x perks points for multiples of $50 of One4All gift cards through August 3, which makes this effectively a 6-10% or so rebate on gas depending on your car’s tank size. The best way to liquidate these until tomorrow is buying fee-free Mastercard gift cards at Staples. (Thanks to GC Galore)

A Heathrow spy’s photo studying Amsterdam’s solution to baggage handling labor shortages.