- Chase has a 25% bonus when transferring Ultimate Rewards to AirFrance and KLM’s FlyingBlue program. I have a few viewpoints with this program that aren’t necessarily widely agreed upon in the bloggersphere:

– There are quite a few low priced business class awards and decent availability too

– The currency is rather valuable for travel from the US to Europe and Northern Africa

– KLM’s 787 hard and soft product are both underrated

– AirFrance’s angled lie-flat business product isn’t nearly as bad as people say, it’s 90% as good as a regular lie-flat seat (but still avoid it if there’s another option) - The Citi Shop Your Way Rewards card is mentioned here almost as often as office supply store gift card deals, but there’s a good reason: It’s ludicrously lucrative and all of the targeted offers stack with one another.

For April, there are targeted spend bonuses for 10% back in statement credits in restaurants, gas, and groceries once per month in April, May, and June. My particular offer requires spend of at least $700 to qualify and caps out at $800 in spend for the statement credit, but ymmv. - American Express has a 30% transfer bonus for Membership Rewards to the Hilton Honors program, so the bonused rate is now 1 MR to 2.6 HHonors points. This is a great deal for certain properties and a horrible deal for others, so just run the math before transferring. As a concrete example, I’m writing this from a Hilton property that’s 90,000 points or $799 a night. With the transfer bonus, I’d need approximately 35,000 Membership Rewards, and I’d get about 2.3 cents of value for each Membership Reward point.

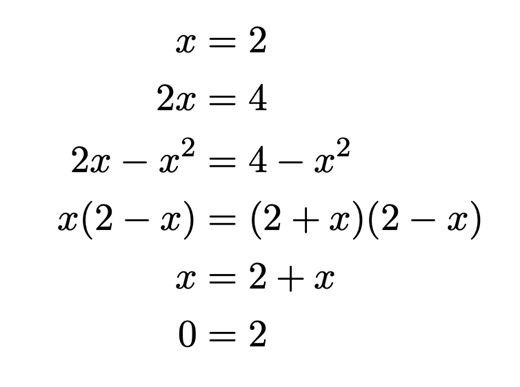

Reader homework: Prove mathematically that this transfer bonus is a bad value for any Hilton property in Lubbock, TX.

Trying to prove value at Hilton properties in Lubbock, TX.