Bank of America, Wells Fargo, Chase, Citi, and plenty of your favorite credit unions offer premium (or sometimes even fee-free) cards that offer annual credits tied to the calendar year. Most issuers also let you refund an annual fee up to 30 days after it posts too. Combined, that means December is often the best time of the year to get a card because:

- Your first statement is usually issued 30 days after getting a card

- Your annual fee posts on the 12th statement around 360+30 days after opening

- Most issuers give you an annual fee refund if requested within 30 days of posting pushing that to 360+30+30 days

- 12 statements will straddle three calendar years: 2024, 2025, and 2026

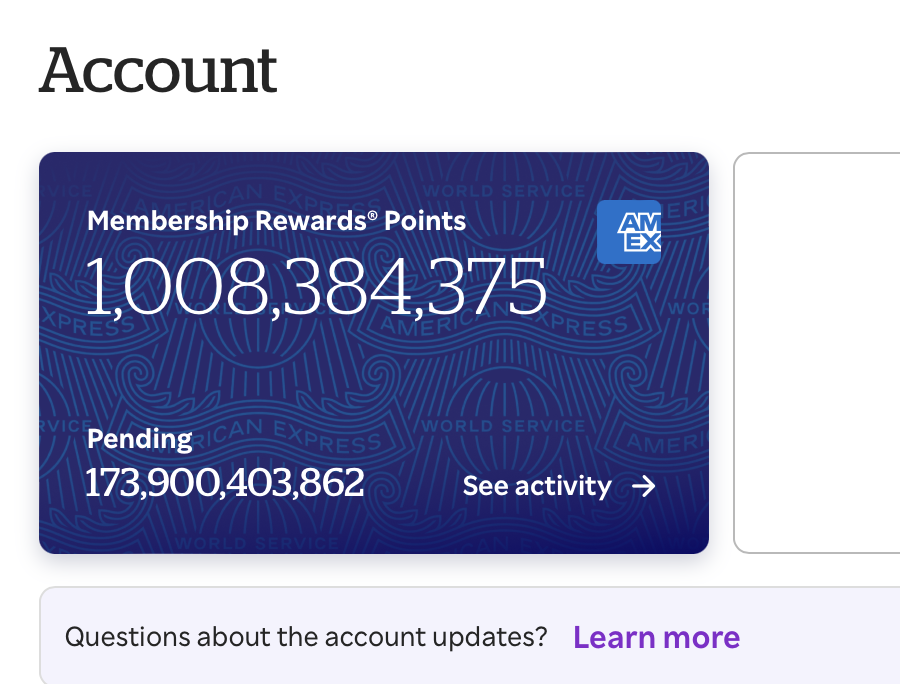

Let’s take the American Express Business Platinum. Annually, you’ll earn (amongst other things, like I dunno, prolly a $1.50 monthly credit to Dollar Tree):

- $200 airline incidental credit

- $400 Dell credit ($200 in the first half and again in the second)

- $199 Clear credit

So if you apply for a card in late November or December, your 12th statement won’t generate until between mid-December 2025 and mid-January 2026. Once that happens, you’ve still got another 30 days for games and an annual fee refund. You’ll get:

- $600 in airline incidental credits (2024, 2025, and 2026)

- $800 in Dell credits (2H2024, 1H2025, 2H2025, 1H2026)

- $450 in Adobe credits (2024, 2025, and 2026)

- $597 in Clear credits (2024, 2025, and 2026)

(though you should discount those Adobe and Clear credits significantly)

There are a few gotchas to watch for: Bank of America’s annual fee refund after it posts isn’t guaranteed; Capital One’s is guaranteed, but the guarantee is that they definitely don’t offer fee refunds; or how the stupid Dell credits may be going away from the American Express Business Platinum in July, 2025.

Happy Tuesday!

Next time: The Halloween triple dip?