Introduction

I’ve avoided writing about the United Quest credit card for a while because honestly the card annoys me (see below), and United really annoys me (also see below). That said, it can be a decent deal for the first year if you’re going to redeem for United flights, and there’s now a mostly public offer for 100,000 miles after $10,000 in spend. You can also use a referral link or get a referral from a Chase United card holder. (I’d chose TravelBloggerBuzz’s link, but you could get a link from another blogger you trust too, just not me. I don’t personally push referral links, that’s not why I’m in this.)

Why Quest Sucks

Rather than going over the positives of the card like everyone else, let me address the negatives, especially as compared to the mid-tier American Express Personal Gold card:

- Quest’s spend bonus categories are weak for a card with a mid-tier annual fee ($250). I get bigger and better bonuses and bonus categories at the same price point with the American Express Personal Gold (e.g. 4x vs 2x at restaurants, 4x vs 1x at grocery, 3x on all airlines vs 3x on only United)

- Quest’s annual “credits” are 5,000 miles after you take an award flight on United, twice a year. The Personal Gold gives $120 in Uber/Uber Eats credits and $120 in GrubHub/ShakeShack credits a year whether or not you redeem miles

- Quest doesn’t give you two United Club passes, unlike its cheaper sibling, the MileagePlus Explorer card

- Quest opens up “XN” fare bucket award availability, but so does the $95 annual fee MileagePlus Explorer card, as does the no annual-fee MileagePlus Gateway card

- A modified double dip is a much better deal than the Quest if you’re under 5/24, and you can still turn those miles into United MileagePlus miles — you’ll also get 3x on all travel with a Sapphire, not just on United like with the Quest card. The American Express Personal Gold doesn’t care about 5/24 at all and also gives 3x

- For a whopping $72,000 in annual spend, Quest will give you 3,000 PQP — uh, ok. For those of you fortunately not sucked into United Elite speak, a PQP is part of obtaining elite status, and 3,000 PQP is what you earn by spending approximately $3,300 on airfare. Trust me, your $72,000 in spend in the right places can earn you $3,000 in actual cash. Wouldn’t you rather have that than stupid PQP? I would

- Quest gives you exactly one currency, MileagePlus miles. The Personal Gold gives you membership rewards, which you can transfer to less sucky airlines or cash out at a decent rate

Why United Sucks

Look, I get that some of you like United, and that’s ok, it’s definitely not all bad. United will usually get you where you’re trying to go, you might get a stroopwaffle, and they do offer many loopholes to those in the know (example: I once used same day changes every day to extend a trip by a week). I also get that some of you live in Houston or Newark and you’re a hub captive, and that’s also ok. But United:

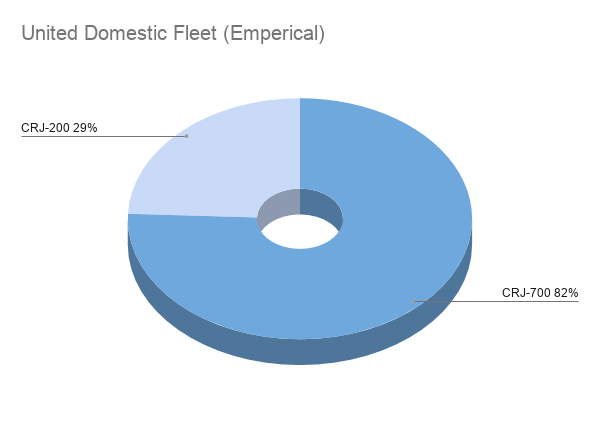

- Flies more cramped regional jets with gate checked bags than any other major domestic carrier, though this may have changed due to COVID (if you’re lucky enough to get the CRJ550, the cramped part doesn’t apply)

- Often flies regional jets routinely between large cities with 3+ hours of blocked time, that’s a long, long time on a regional jet between two major business hubs like Atlanta and Denver

- Often flies worn-out 737s or A319s on non RJ segments, and believe me when I say worn-out — some of these planes haven’t seen any love with respect to passenger comfort in a decade

- Has Scott Kirby running the show, and Scott is famous for pinching every penny possible to ensure that you’re not getting any more than absolutely necessary

- Offers dynamic pricing for award tickets, and many times charges more just because they can, though to be fair so do the other major domestic US airlines at this point

- Often overbooks landing slots at crowded airports, leading to massive system delays

- Still flies business class seats without direct aisle access

So, do you really want to get 100,000 miles and subject yourself to all of that with no other option? Honestly, I don’t unless it’s a last resort. But maybe if you’ve got a use for those 100,000 miles and don’t want to do the Modified Double Dip for some reason, this is still ok.

5 thoughts on “United Quest Credit Card: A Contrarian View”

Comments are closed.