- Do this now: Check for spending bonuses on your Chase Ultimate Rewards earning cards. I’d check each card in a new private browser tab to avoid error messages after one or two cards. We’ve seen:

– 10,000 points on $400+ or $500+ in flights, rental cards, cruises, or activities

– 20,000 points on $500+ in hotels

These require booking through the Chase portal. - Alaska has a fare sale on flights booked today for travel between January 28 and March 19:

– Short haul: 4,000 miles

– West coast to and from Hawaii: 7,500 miles

– Long haul: 10,000 miles

I usually call these the best sales that no-one talks about, but for some reason people are talking about it this time. Success! 🎉 (Thanks to FM) - Breeze also has sale for 40% off of base fares on flights booked by tomorrow night for travel between January 14 and September 2 with promo code LOCKIN.

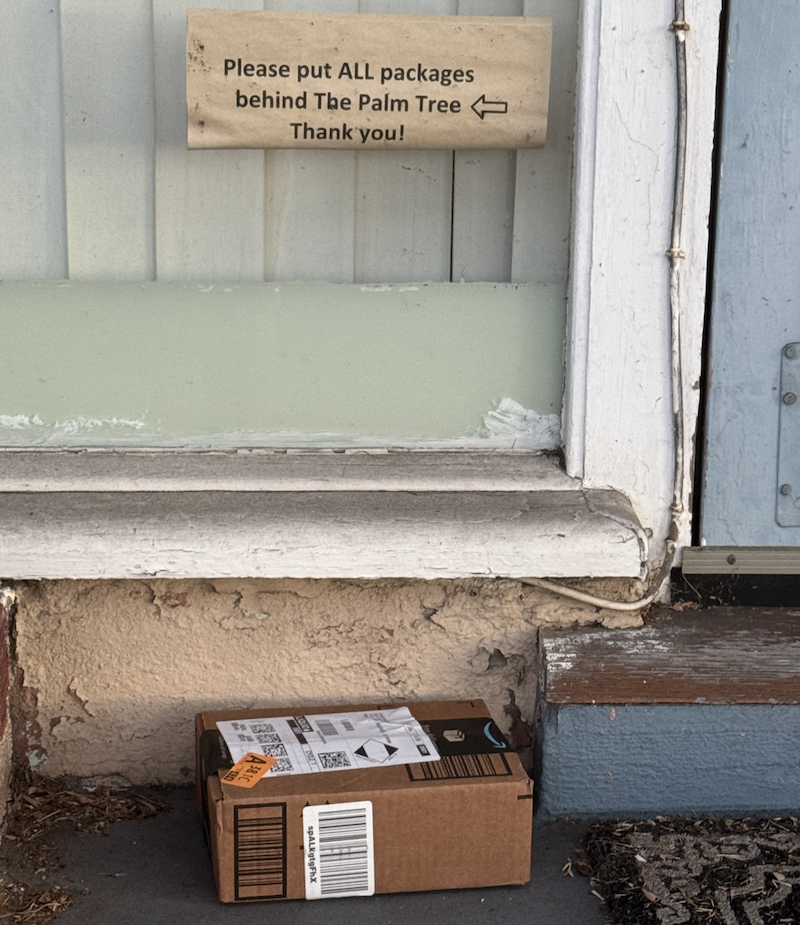

It’s been awhile since we’ve played Breeze route bingo, but we can fix that today. Today’s Breeze bingo route is: Scranton-Fort Meyers! Congrats to today’s bingo winners. - American Express offers has an offer for $100 off of $500+ or $200 off of $1,000+ in Delta Airlines airfare through March 31. Gamers gonna game, and the easiest of all of the games is to book a non-basic economy flight, wait 24 hours, then refund to a travel credit for future use. More complex games may yield better results.

- Korean Air first class award space is now available and has been since at least January 3 for the first time since 2020, and I missed it when talking about airline mergers on Monday. First class awards are 80,000 SkyPass miles each way from the US to Asia, so this could be the reason you need to transfer miles from Marriott Bonvoy to Asiana in anticipation of Asiana Club miles converting to Korean SkyPass miles this Summer.

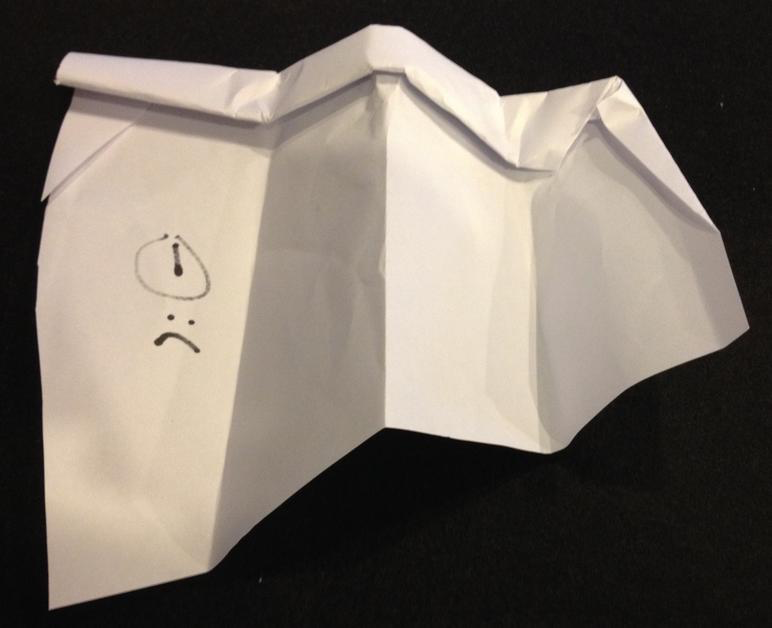

January 2025 Breeze Airways Bingo prize: This paper airplane