EDITOR’S NOTE: Matt is on vacation until at or around January 1, 2026. Until then we have guest posts, today’s post is brought to today’s post is brought to you Sam from HelpMeBuildCredit.com and from the CardRight card tracking tool. Special thanks for the post!

Identity theft is on the rise, with over $12.7 billion stolen in 2024 in the U.S. And guess what? Just like we like to make money off our couch, thieves learned how to do that as well (they call it Couch MG, which stands for money grab). But don’t worry, we’ve got a plan to keep your personal info locked up tighter than a bank vault, and now it’s the thief’s turn to be tripping on rakes.

Here are the steps to take to bulletproof your identity. However, please note that not all steps are necessary if you have never been a victim of identity theft (unless you have the letters OCD following your name). But this info is good to know just in case you ever do become a victim, God forbid.

- Guard your credit like a precious possession

Identity thieves love opening credit cards in your name (and no, it’s not because they want to earn a welcome bonus). Don’t let them mess with you! Here’s how to keep them out:

- Credit freeze: Lock your credit reports so no one can sneak new accounts under your name. It’s simple and free.

- Credit monitoring: Sign up for a credit monitoring service to get alerts when something shady happens with your credit. If you see an unfamiliar inquiry, you can throw the thief a rake.

There are various free credit monitoring options that alert you on one or more credit bureaus.

If you want to receive alerts to all three credit bureaus for free, you can sign up to the following credit monitoring services:

– Credit Karma: Monitors Transunion and Equifax.

– Experian: Monitors Experian.

– Chase Credit Journey: Chase Credit Journey also provides your free report from Experian, but in addition, you get the benefit of identity theft insurance which they offer (If it’s free, why not take two?)

- Credit freeze: Lock your credit reports so no one can sneak new accounts under your name. It’s simple and free.

- Fraud alert: This is like putting a “Do Not Enter” sign on your credit report, though it can slow you down when you need your own credit. Use this if you’re extra paranoid.

- Tax and employment fraud: not on your watch

Thieves can also file fake tax returns or claim employment/unemployment benefits in your name. Here’s how to stop them:

- Tax fraud: Get an IP PIN from the IRS. Think of it as a secret code that only you know. Also, try filing early to beat fraudulent tax filers.

- Employment fraud: Request a wage transcript from the IRS and report any unemployment fraud to the U.S. Department of Labor ASAP.

- Tax fraud: Get an IP PIN from the IRS. Think of it as a secret code that only you know. Also, try filing early to beat fraudulent tax filers.

- Bank accounts: don’t let them drain ‘em

Thieves might try to clean you out or open new accounts in your name so they can do some fun stuff with it (which does not include earning a welcome bonus). Order your credit report to check for fraudulent activity from companies such as ChexSystems, CrossCheck, AskCertegy, or the like.

Set up fraud alerts with your bank and review your statements regularly. Use strong passwords (and consider two-step verification) to make it harder for them to access your accounts. - Investment accounts: hold on tight

They can make off with all your investments. In order to protect yourself, use an investment brokerage that offers protection against fraud. Fidelity and Charles Schwab are good options. - Medical identity theft: they cannot have their share in your doctor’s prescription

Someone could use your medical insurance to get treatments or prescriptions in your name. Keep your docs in the loop, and always review your credit report for medical collections that don’t belong to you. Dispute any mistakes from your medical records. - Criminal identity theft: don’t get caught in the wrong place

If a thief uses your identity for criminal activity, it could cause major complications – especially if you’re wrongly linked to crimes. If this happens, get legal advice pronto. You can also sign up for dark web monitoring, such as Identity Force, to keep tabs on any shady activity tied to your info.

Sneaky trick to try

Now, once I have the mic, let me add one more safety tip. Here’s a trick to check whether a suspicious caller is a scammer:

Your phone rings, and you suspect that an individual with fraudulent intent is on the other end of the line. While the caller is likely speaking English, ask for a Spanish-speaking representative. Every bank has a department with Spanish-speaking reps, while the thieves don’t. If the call is authentic, they will transfer you to the Spanish (or Espagnol, as they say) department. If that happens and you’d like to continue in English, ask to get transferred back to the English team, or ask the rep if they speak English as well (they very often speak both).

– Sam, HelpMeBuildCredit.com, CardRight.com

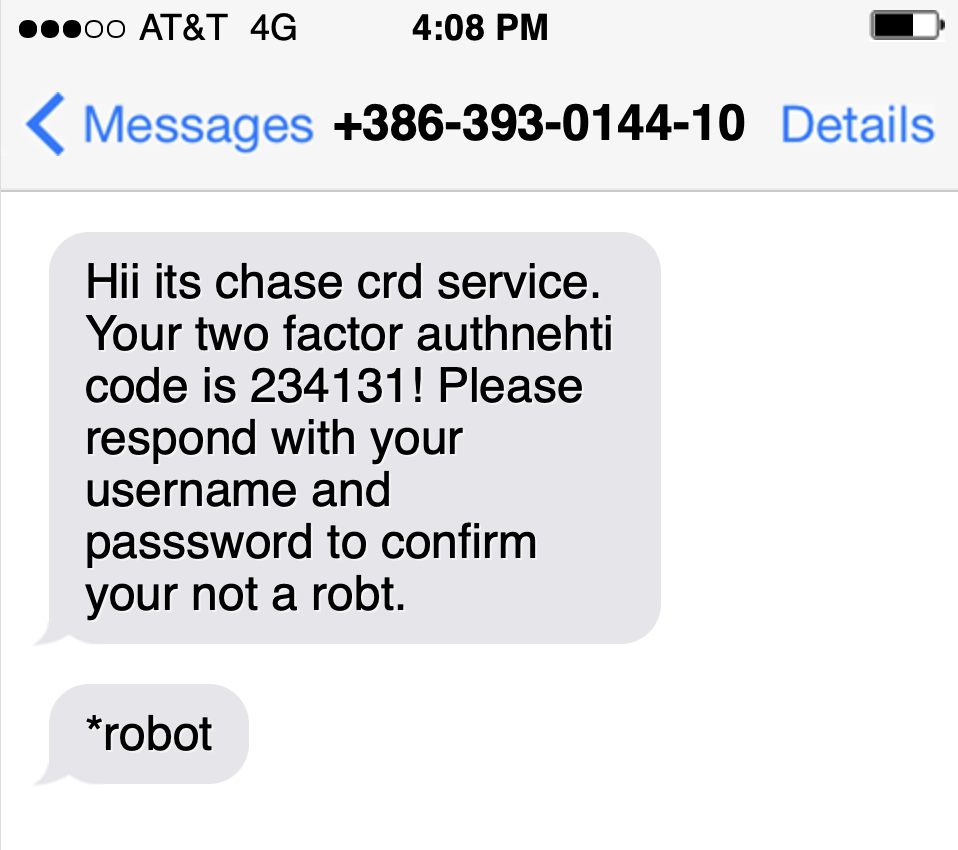

Not all two factor authentication services are real though, even this legitimate looking one.