Introduction

I’m not a financial advisor and I’m definitely not your financial advisor, but I get questions almost every week about my investment strategies for reasons known only to Betty Badluck. My best advice: seek a low cost total market index fund and HODL. Of course this isn’t that kind of blog though, but there is a travel hacking angle here so: Hey, how you doin? Let’s chat!

My Strategy

My investments fit a simple allocation strategy, and I rebalance my portfolio every three or so months to make sure that the allocation stays proportional:

What’s the MEAB special? It’s stocks that I pick individually for some particular reason, but proportionally allocated in a way such that a catastrophically bad pick won’t be able able to wipe out the majority of my holdings. Historically that 10% generally outperforms the rest, but I attribute that to luck moreso than skill and don’t expect that it’ll continue that way.

The Travel Hacking Angle

There’s always a travel hacking angle, right? Well, as frequent flyer hackers we get an inside view into the operations, rise, and fall of airlines in both a specific and general sense. For me, that means that I have an insider view into how an airline performs that goes above and beyond the information in a 10-Q, and if I’m going to be choosing an airline to hold in the 10% MEAB special, that information may or may not give me an edge.

To be clear: investing in airlines is a tough business and I don’t recommend it, but if you do it, augment the public filings with information you’ve got from your inside view.

Finally, to answer the question that exactly none of you asked: When I invest in the airline industry I short one airline stock and long another airline stock to try and earn based on relative performance while avoiding losses from general industry crapluence. Sometimes it works too, probably just like sometimes a broken analog clock is right.

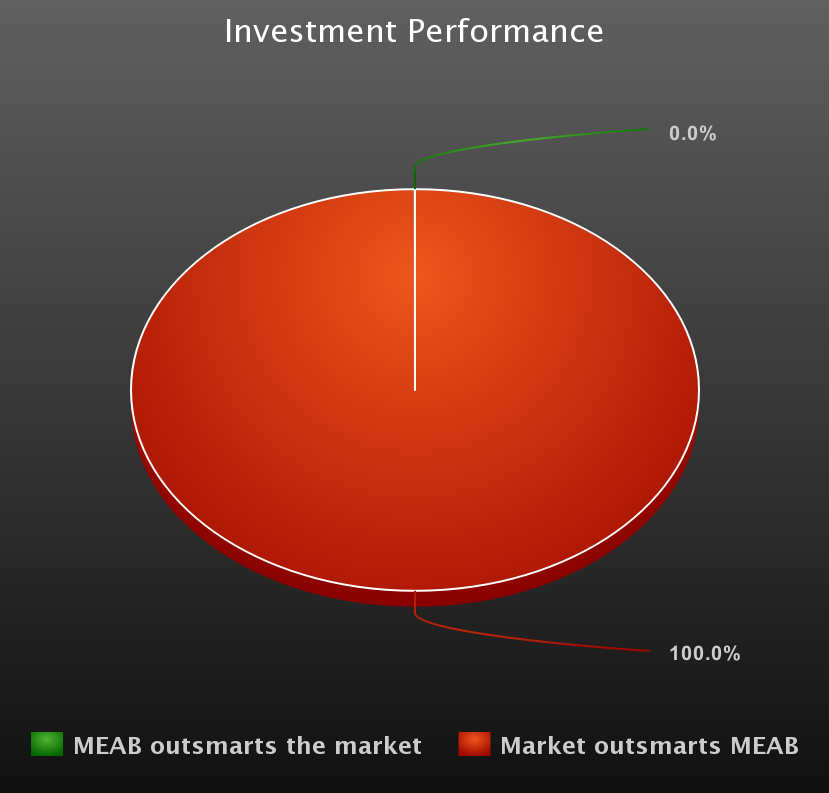

MEAB’s investment skill.