MEABNOTE: I’ll be going on a blogging vacation at the end of the year and there won’t be any daily posts between December 15 and December 31, at least none from me. We may have guest posts during that period, but that depends on you sending me some. On January 1(ish), we’ll celebrate with the 2025 version of Travel Hacking as Told by GIFs.

I have an upcoming FlyingBlue award flight that I need to cancel. Sometimes you can do that online, but: (1) often the option isn’t available or errors out if it is, and (2) doesn’t work if you need to pay the cancellation fee with a different card than you used to book.

I fell squarely into the second category. I had booked a reservation in May with a card I don’t have any more because churning, which means I needed to call in to cancel. I looked at a trusted list of airline customer service phone numbers. I found the FlyingBlue number, typed it into my cell phone and called.

I’ve been through FlyingBlue’s customer service center plenty of times, and immediately a few things were off about the call:

- The FlyingBlue jingle didn’t play (maybe they changed it?)

- There was no hold time after dialing the number for reservations (weird, but it was very early in the morning in the European Union and late in the United States so maybe that’s why?)

- The representative’s accent was really mild, and didn’t sound french at all (maybe a non-french employee?)

- The cancelation fee quoted was incorrect (this happens with regular FlyingBlue all the time though, it works itself out with the automated system, so on brand)

- The representative asked which website I used to book “for security” (I’ve never been asked that)

- The representative asked for my credit card directly (FlyingBlue transfers you to an automated system for credit card entry)

The last one really made the alarm bells ring. I asked the representative about the automated system, and he told me that he can do it directly, there’s no longer a need for the automated system. Because we all have momentary lapses of judgement and I’m certainly not immune, I read the representative my credit card information. After that, he said there would be a 10-15 minute hold while he processed the cancellation. I was now convinced that this was a scam, but I confirmed I’d wait on hold.

I logged onto my bank’s website right away and locked the card. Right after that, I hung up the phone and within 30 seconds got a call from an “Unknown Caller”. I didn’t answer, then a minute later I got another, and another minute later another came in. Then again an hour or two later and once more an hour or two after that. At least scammers have good customer service when a call disconnects?

Now that I had a moment to think and investigate, I went through my call log to double check the phone number I’d dialed. At this point it should be no surprise – I had indeed made a mistake. I’d taken the “1-800-237” from the FlyingBlue phone number and then took “2262” from the Aeroplan phone number accidentally. CI had dialed the wrong number. It’s wild, but someone had anticipated this sort of mistake and set up a phone number to field calls from people like me.

My next steps:

- Report my credit card lost/stolen

- Double check for pending charges on the card (there weren’t any)

- Change my FlyingBlue password, just in case

- Turn on “Always Require 2FA” on my FlyingBlue account which really should have already been turned on

After all that I was in a position to cancel the ticket, this time for realzies. I dialed the correct FlyingBlue number 1-800-237-2747 (hyperlinked here so you can click it instead of typoing it) and was met with the FlyingBlue jingle and a hold. I waited on hold 15 minutes before I decided to deal with it tomorrow and hung up. At least the hold confirmed that I’d dialed the correct number the second time, hooray for holds or something.

The lessons:

- Triple check reservations phone numbers, ideally click a hyperlink from a loyalty program’s app instead of typing it in manually

- Know how to lock your cards quickly in case you didn’t do the above

- Be ready and willing to bail on a call, ideally much earlier than I did

Good luck out there and happy Monday!

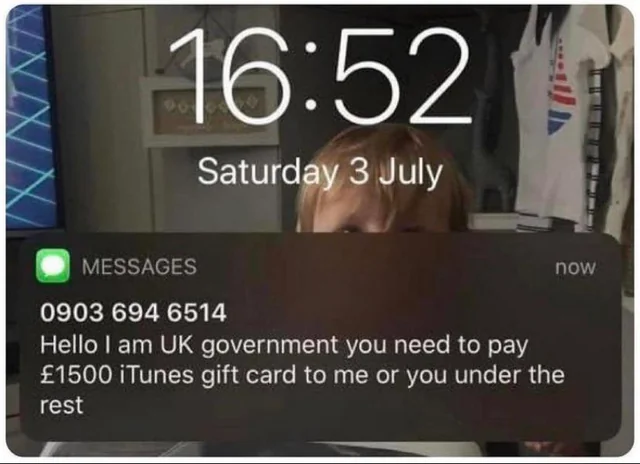

This one could be real though.