Introduction

A new credit card that offers uncapped 6% in cash-back at grocery stores through the end of 2023 issued by USAlliance Credit Union surfaced early in the weekend. When a great opportunity like this rolls around, there are two ways to play it:

- The prudent method: Ramp-up spend and focus on longevity

- The hog method: Going ham by hitting the deal as hard as possible, anticipating an early death

How do you decide which method to use?

Prudence

Sometimes you’ll make more over the long-term by exercising some restraint and caution as you play the game. That usually means:

- Not cycling credit lines until the bank’s patterns are better understood

- Ramping up spend over the course of a few months

- Varying transaction sizes and patterns to obscure manufactured spend

- Doing no more than one transaction per day

When you’re being prudent, you’re implicitly deciding that a deal will probably be around for a long while and you’ll make more and have less frustration by nurturing it throughout its life.

Hog

Sometimes a deal almost certainly won’t last for more than a few months, and your best return will come from hitting it as hard as possible. That looks like:

- Cycling credit lines immediately

- Overpaying to create a negative balance for more total spend

- Hitting the deal as many times a day as possible

Getting shutdown after months of doing the above is almost inevitable at any bank, large or small; so don’t be surprised when the axe comes down.

Which Method to Use with USAlliance?

Back to the 6% uncapped cash-back at grocery card, let’s discuss where we are:

- The deal went mainstream yesterday

- USAlliance is a medium sized credit union with slightly more than $2 billion in assets

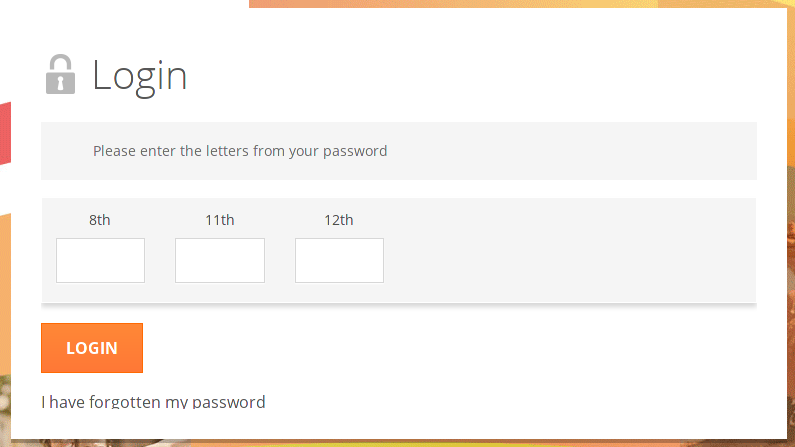

- USAlliance is losing a lot of money on each grocery transaction (The interchange fees on grocery are going to be between 1.40% + $0.05 and 2.10% + $0.10, depending on the store’s coding and transaction volume; see page 9 of the Visa interchange fee reimbursements PDF)

- Some heavy hitters are going to go big on this deal

When deals like this happen at a medium sized bank, you’ve typically got a good shot at longevity because your activity is drowned out in the noise. USAlliance is losing somewhere between 3.9% and 4.6% on a grocery transaction though so I don’t think it’ll take much activity to rise above the noise. To me that means the right choice is to hit this one as hard as you can and expect that it’ll die in several months.

Good luck friends!

This car chose hog.