Background

I couldn’t find an affiliate blog that wasn’t talking about Richard Kerr’s / Bilt’s Blit’s new Cardless issued credit card lineup yesterday. Of course being the subject that affiliates talk about for a day doesn’t necessarily mean the Bilt lineup is bad, but it does mean you should be even more skeptical than normal and look at the content as though it were written by a marketing agency, because it was. But I’m getting ahead of myself, let’s MEAB style distill the news without 2,000 word articles:

- Bilt commemorated the launch with a stupid banana trophy to make fun of manufactured spenders

- There are three flavors cards, each with a different annual fee, multiplier, and set of coupon credits:

- $0 annual fee, 1x everywhere

- $95 annual fee, 3x on dining or grocery (max $25,000), 2x travel, 1x everywhere

- $495 annual fee, 2x everywhere

- Bilt invented a new currency that’s earned at 4x,

Itchy and Scratchy MoneyBilt Cash - Bilt Cash’s only use is to allow you to earn points for paying your rent or mortgage with a Bilt card

- For the only churner on the planet without a Priority Pass, $495 will get you one

- There are more hotel credits that aren’t really worth much

- There are small sign-up bonuses

There are other largely meaningless card features too, but I promise they almost certainly don’t matter to an average churner.

Talking Points that Affiliates Can’t Say

Affiliate relationships tightly control the content of news articles, so let’s mention a few things that they can’t:

- Cardless doesn’t like manufactured spenders

- A shutdown from Cardless is a lifetime Cardless ban

- There’s a good chance that a Cardless shutdown means forfeited points for the most recent statement cycle

- Bilt’s best transfer partner is Hyatt – you can spend $495 for 2x Hyatt everywhere with Bilt and it might last a while without cycling, but you can earn 1.5x Hyatt everywhere with a Chase Ink Unlimited which is much more tolerant and has a much bigger sign-up bonus

- Many of the card’s advertised benefits come by virtue of being a Mastercard and you’ve probably got those same benefits on other cards

- If you use an affiliate blogger’s link, they’re earning several hundreds of dollars in Bilt kickback; their sign-up bonus is probably bigger than yours (by all means, support affiliate bloggers if you like them, just make it a conscious choice and not a default one)

Finally, let’s talk about converting existing Wells Fargo Bilt cards:

- You’re going to have yet another new personal card on your credit report

- You may not be approved even if you have the Wells Fargo card

- You’ve got to decide to convert by January 30 to avoid another hard pull

- You won’t get a sign-up bonus as part of the conversion

For those keeping track at home, this is the third new credit card on personal credit reports for early Bilt adopters.

The MEAB Wrap

The affiliate hype machine is great at getting the word out and great at getting you excited, but it’s also good at glossing over the negatives. When a media blitz hits, be extra careful. There’s value in Bilt 2.0, but there’s plenty of downside too and a looming threat of a shutdown.

What’s my takeaway? Well, personally I just want the banana trophy or a replica as a peace offering from Richard Kerr.

Happy Thursday!

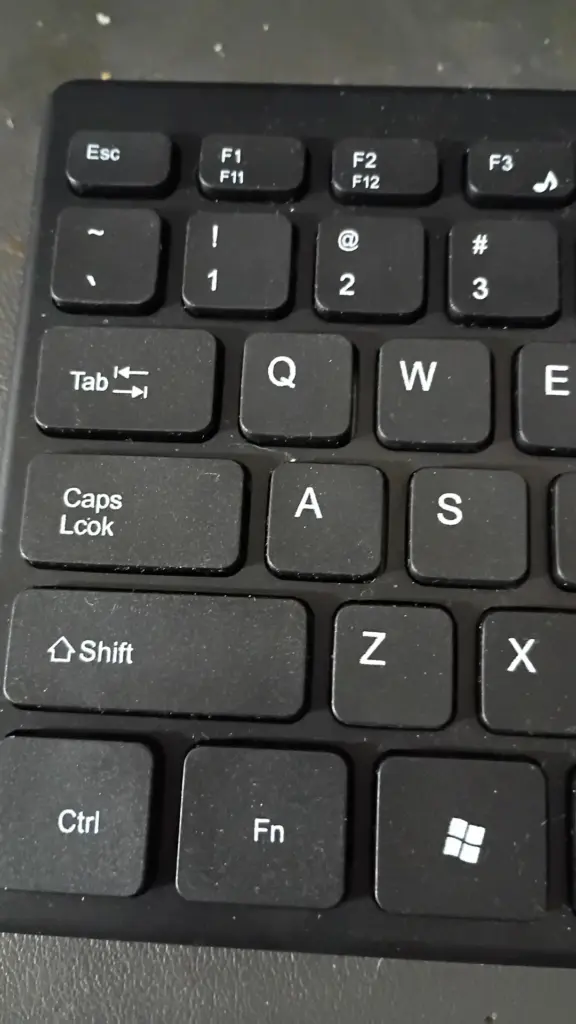

Look, sometimes misspellings are intentional, just ask Dell about its Caps Lcok key.