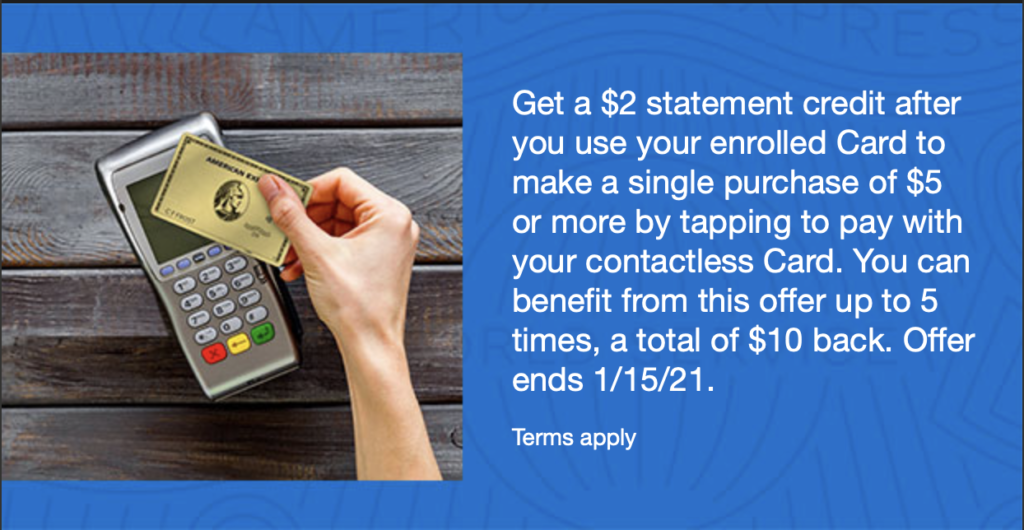

Until recently, you could bank monthly AmEx Uber Credits to your Uber Cash balance by using an accidental or purposeful cancel of a ride under certain conditions. That stopped working, which means you’ve currently got to use your Uber Credits as AmEx intended.

There’s a rub though, both Uber and Uber Eats are supposed to draw from your monthly expiring AmEx Uber Credit before they draw down your banked Uber Cash, but it isn’t working that way on Uber Eats. Instead, your banked cash is used and your credit stays put, ready to expire at the end of the month. If you’re one of the four people out there taking actual Uber rides it still works like it’s supposed to, but if you’re like everyone else, you’d probably rather use it on Uber Eats and you can’t with an Uber Cash balance.

Sam at Milenomics proposes a workaround: Spin up a second Uber account, de-link your AmEx Uber Credit cards from your primary account, and link them to the secondary account. That way, at least next month you’ll have those credits on an account without Uber Cash.