MEABNOTE: I’ll be going on a blogging vacation at the end of the year and there won’t be any daily posts between December 18 and December 31. After that, we’ll ring in the new year on January 1, 2025 with the 2024 version of Travel Hacking as Told by GIFs though, so no need to be up in arms, but I guess it’s ok if you’re up in legs.

By popular demand we’ll have at least a few guest posts during the break. If you’d like to write one, please reach out, I’d like to find guest posts for the whole break!

Introduction

We’ve talked several times about the Pepper Rewards gift card selling platform, which seems to have been explicitly designed to transfer money from Venture Capitalist bank accounts to our wallets at lighting speed. In the most recent MEAB post on the subject, I included a toy model based prediction that there’s a 50/50 chance that the company fails by the end of 2024. I’m now updating the timeline for the 50/50 failure scenario to be March 23, we’ll see why later.

Recent Changes

First, let’s discuss how Pepper has changed in the last month:

- Bonus offers are now targeted to specific accounts

- Many of the best offers are now limited to one per account per day

- New accounts get low bonus offers until they spend five-ish figures

- Account limits are either $5,500, $7,000, or $10,500 spend per rolling 24 hours

- Most of the rebates are now floated for 14 days

- Pepper has effectively stopped responding to most support requests

- Pepper is moving merchant accounts from Stripe to PayArc

The first two bullets seem to be Pepper’s attempt at preventing a few whales from taking all of the best deals’ capacity through botting. The third and fourth bullets seem to attempt to separate gift card resellers from regular users and to separate resellers into tiers. The last two bullets are almost certainly about saving money and lowering reserve capital requirements.

Recent Deals

As degenerate churners are well aware, Pepper has pushed the resale market for high value gift cards down to decades-long lows by offering almost daily:

- 17-20% discounts on Kohls gift cards

- 12-16% discounts on Amazon gift cards

- 12-16% discounts on Walmart and Sam’s Club gift cards

- 15-18% discounts on Nike gift cards

Let’s get something out of the way about these deals: There’s no world in which Amazon or Walmart are giving gift card sellers a discount in the double digit percentages on millions of dollars of inventory. There’s also no world in which Pepper isn’t paying merchant processing fees of at minimum 2.7%, but more realistically 3%+ on each of these transactions too. Pepper is losing on each of these bulk gift card transactions, period.

Pepper’s Vision

Pepper has started a new funding round a month or two later than I expected based on the toy model, but still within the general time frame. Fortunately for us, their pitch deck and story is on YouTube so it’s easy to see what they’re telling investors. My favorite bits from the video:

- Pepper is going to be a single shopping portal and remove the need for all the others

- “Pepper earns a 6% commission on every transaction”

- Pepper somehow will know your favorite color and shoe size with AI, and this isn’t MEAB snark

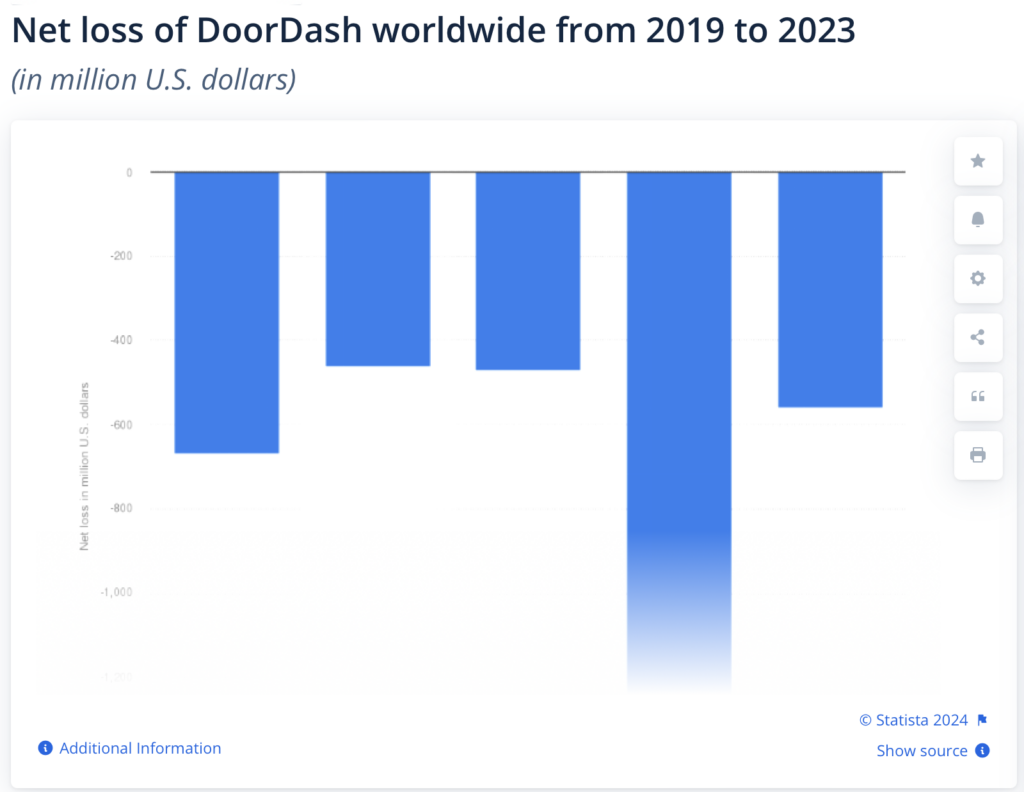

- Their Chief Revenue Officer was a DoorDash sales executive

- Pepper believes that their total addressable market is $6 trillion (almost 23% of the US GDP, seems legit)

There’s definitely a fair amount of slippery language in the video, but I want to call out the most slippery statement, that “Pepper earns a 6% commission on every transaction”. Look, I actually believe they earn an average of 6% commission on every transaction, but the slippery language is undoubtedly that their 6% is a gross commission on the face value of gift cards, not a profit margin. (I think Pepper is lucky if their current profit margin is -6%; it’s definitely not +6%.)

Side note: I think that 6% number is realistically the discount that they earn on face value for the aggregate of all the gift cards that they sell, making it a really interesting number for any future models.

The Pepper Future

Alright, we’ve buried the lede. Based on my toy model I expected a 50/50 failure by the end of 2024, but I’ve revised that to 50/50 by March 20. Why that date? It’s silly, but there’s a metric that’s more accurate than any toy model in my mind: Almost all high-growth, high-spend VC backed companies start raising their next round of funding 3-4 months before they run out of the cash from their last round; it’s almost universal for companies like this.

Given the above and that Pepper posted their investor presentation on December 8, three months is March 8, and four months is April 8, the expectation value for running out of money is March 23. If they haven’t run out of money by then, it’s probably for one or both of two reasons:

- They’ve raised more cash successfully

- They’ve restructured their expenses, including employee and boost costs

I’m sure Youtube is the way to most investors hearts though, right?

My Action

I still use Pepper, and I have pending rebates well into the thousands of dollars floated with them too. My goal is to scale that back gradually as March approaches to limit my exposure in case of a Pepper failure. If this was a public company, you can be completely sure I’d be buying out of the money puts. I also expect that I’ll end up losing some money when they eventually fail, but I can more-or-less control how much and take profits in the mean time.

Good luck and happy Tuesday friends!

The Pepper Chief Revenue Officer’s prior work gives a glimpse into Pepper.