The end of the year is fast approaching. If you have a premium travel credit card that reimburses for travel expenses, make sure you’ve used them all. For Chase this is trivially easy because they work for travel, gas, and groceries.

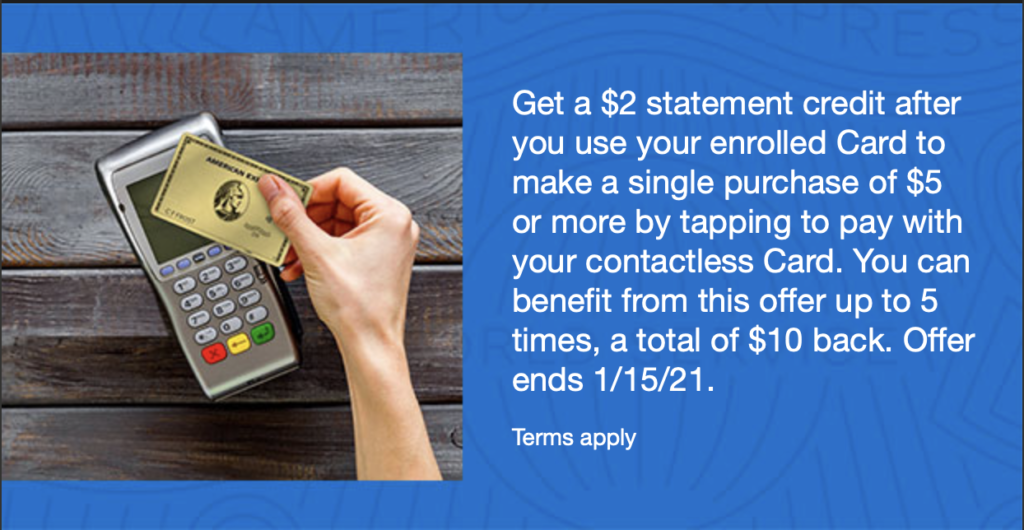

For American Express, let’s just say you’ve got your work cut out for you, though it’s easier during COVID since most airlines will convert small purchases to travel bank funds. For reference, check the relevant Flyertalk thread for the airline you’ve selected:

I can’t believe I’m saying this, but United might be the easiest way to do this with direct funding of their TravelBank.