I know most of you use credit cards, shopping portals, points, and gift cards as part of your overall travel hacking strategy. Maybe my sample size is just too small, but I don’t really know of anybody including cell phone burners in that strategy regularly, and I think that’s a mistake. All you need to start with cell phone burners is an unlocked phone and some cheap SIM cards. I’m guessing a lot of you probably have an old, cracked-screen unlocked phone already in your junk drawer so you don’t even need to use your main phone for SIM swapping.

Here’s why cell phone burner numbers are useful to a travel hacker:

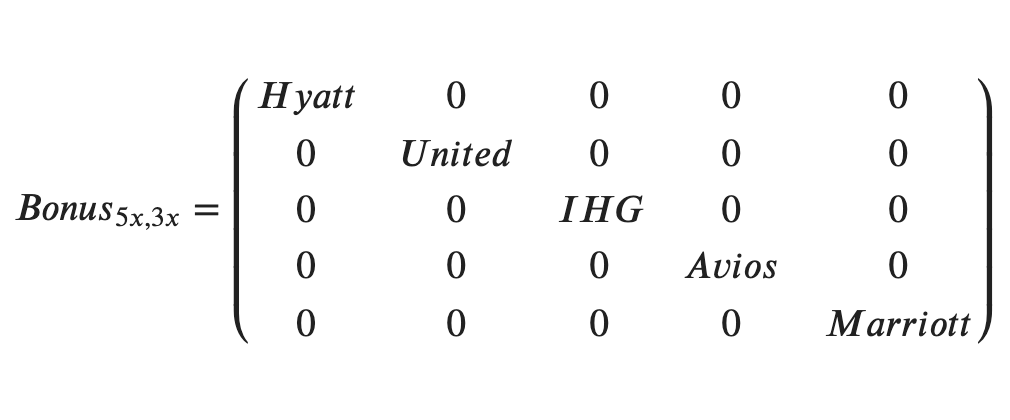

- Uber Eats gives new accounts $25 off of orders, and $10 off for referrers. (A new account really means a new phone number).

- DoorDash gives new accounts 3x$10 off of orders, and $15 off for referrers. (Remember, new account really means new phone number).

- CashApp gives new accounts $5 and the referrer $5, but more importantly, you have more access to some of the excellent CashApp boosts. (New account = new phone number, blah blah blah.)

- Fluz gives 3×35% off vouchers for gift cards to new accounts, and 1 voucher to the referrer. The referrer also gets a very small percentage of the commission on gift cards purchased by accounts that they referred.

- Deals come up all the time that require an existing number. When you’ve got an existing number that you don’t use, you can it take advantage of that right away without affecting your main phone number. A recent but not representative example of this deal was buying 10 Xfinity iPhone SEs for $15/mo total ($1.50/phone). Lots of times, the deals only need a single phone number for port-in or trade-up, they’re not all this complex.

- Are you banned by a store or an airline? Using a name variation, address variation, and a new phone number, say from a burner, will usually get you jump-started and back in the game.

There are always deals like the above coming up, and having burners lets you take advantage of them at scale.

Here’s why I’m writing this today: BestBuy and Target are both selling Ting SIM cards with two months worth of credits for $0.99. With each SIM card, you can get a new burner number. You don’t have to use them right away either; you can buy a couple now and put them in your sock drawer for when you need them or want to use them in the future.

When you set up the Ting SIM card, give them a Citi Virtual Account Number card or similar that expires before they try to start billing you for the third month so you don’t have to remember to cancel. If the number is useful, you can keep it for $5 per month by porting it to Tello. (Don’t forget to use a portal for $10+ back from Tello when you port.) I’m sure there are other ways to keep a phone number for even cheaper, but I haven’t needed to find them.

My suggestion to you: Buy least two of these sim cards for $1.98 out of pocket, then incorporate them into your travel hacking at your leisure.