Beginning in mid-June I started receiving reports that American Express has imposed spending limits on charge cards and lowered limits on credit cards. Based on the number of reports I’ve received directly and the volume of chatter I’ve seen in various groups the issue is widespread, much more so than we’ve seen in the last several years. What’s going on?

Charge Cards

With charge cards, it seems American Express is doing on of two things to affected accounts (but probably not both):

- Imposing spending limits on mostly unused charge cards

- Taking up to a week after payment to free-up available credit

For active charge cards, spending limits don’t seem widespread (but there are a few reports).

Credit Cards

On the credit card side we’ve seen:

- Credit lines slashed on both idle and actively used cards

- Taking up to a week after payment to free-up available credit

Unlike the charge card side, activity on a card doesn’t seem to protect it from a reduced spending limit.

Observations

So far, everyone that’s been affected by the recent charge limits has one of these two traits with their AmEx accounts:

- Big balances (think 30%+ of stated annual income)

- Lot’s of cycling (similar magnitude)

The language used on the AmEx website when a limit is imposed mirrors the language used when a financial review results is reduced charging privileges. That could mean we’re seeing a new type of financial review (perhaps a “silent financial review”), and having a big balance or cycling your cards quite a bit triggers it.

Assuming this round is like past rounds of spending limits, it’ll probably be stuck on your account for a year.

Why is AmEx doing this?

I don’t have inside knowledge about why AmEx is doing this, but I do know that their two major banking partners aren’t rosy on AmEx’s recent financial performance (Morgan Stanley’s bank analyst downgraded the stock this week and Charles Schwab has given the company a “D – Underperform” equity rating as of yesterday.) Perhaps AmEx is looking for ways to reduce their risk or for ways to shore up their balance sheet?

AmEx’s public Q2 financial results are scheduled for early Friday of next week, so perhaps we’ll learn more then. In the mean time be aware that AmEx seems to be more on edge lately and act accordingly, like maybe drink a beer and chill.

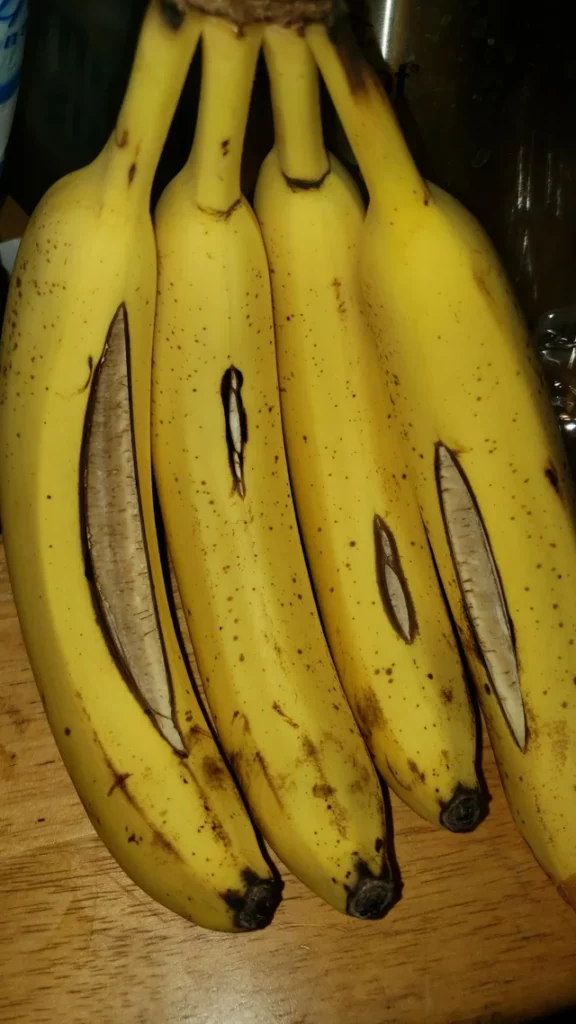

AmEx understands “no preset spending limit” as well as this shop understands 99 cent stores.