After a heavy week of posts, it’s time for a return to normalcy. (Yes I mean the pre-COVID kind. No, I don’t actually have a way to get us there, but thanks for believing in me.) So, let’s jump in with a quadruple:

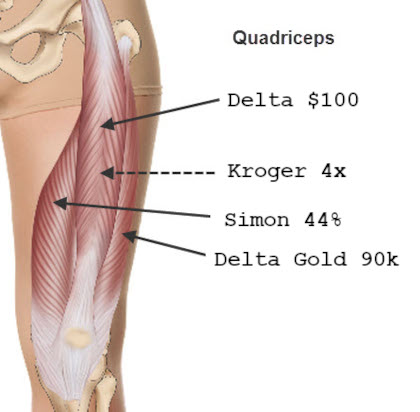

1. Check your inbox for a targeted free $100 from Delta to use by August 31. To search for it, I’d use the query: “in:anywhere from:delta subject:100“. I didn’t get it, but maybe they’ll like you more than they like me.

2. Kroger has a digital coupon for 4x fuel points on gift cards starting yesterday and running through July 13. Expect to see a lot of Marshall’s, Nike, Best Buy, and Home Depot demand from gift card resellers over the next two weeks. The two put together can easily make this a money maker deal before the credit card rewards, and a gonzo deal after them.

3. For your manufactured spending needs (except American Express), Simon has a code for 44% off of fees for purchasing Visa and Mastercard gift cards with the code: FS44JUN

4. Apparently this has been around for a while but it’s new to me: Create a dummy award booking with Delta and during the checkout process you may find an offer for a Delta Personal Gold card with 70k bonus miles, a 20k miles rebate, and no annual fee in the first year. I’d take that offer if I could. Just close it after when the annual fee hits after 12 months, or better yet get an upgrade or retention offer on the card for a juicier win.